"There are no relationships or equations that always work"

Technical Analysis constitutes a vast array of valuable tools that enable traders to gain insights into a stocks future price movements by studying historical price and volume changes, utilizing multiple statistically validated methods over multiple time periods. A complete list of Technical Indicators can be found (here). If you are not familiar with their use or functions please read on.

Let's assume that you are in the military and you are about to join a great battle. What is unusual about this battle is you get the option of deciding, which side you want to join by predetermining which side you believe will win. In the battle of trading stocks, the two opposing sides are buyers and sellers. Now if this were a real battle, where your life would be at stake, how much information would you want, before you made the decision on which army to join? Before you discount this anology, please make no mistake about it, your financial life is at stake if you are investing in equity markets about which you know little or nothing.

Personally I would want to know everything conceivably possible. World events, recent market, segment and industry news, all news that could affected my stock, fundamental information and finally the current price and volume. You can think of Technical analysis as a cryptanalysis technique that attempts to decode the enemies signals providing us with analytical intelligence that will enable us to make the critical decision, of which side is winning and where the next objective or fallback position could be. The stock ticker is the name of the battle, the volume is the number of soldiers involved in the fight and the change in price, indicates who is winning the battle. In the final analysis, reports from the front about how this battle is going will contain the current price, how that price changed relative to the last time interval that it was checked, and how has the volume changed between these two points of time. The harsh reality for retail stock traders in todays market is we are entering a futuristic battle, but most of us are armed only with a small club. The opposing forces are using state of the art, large scale, mainframe computers directly connected to the exchanges with the shortest fiberoptic runs possible. Our only hope in competing is to adopt a gorilla warefare tatics. Hit and run or as I like to call it Swing Trading.

Trading stocks would be considered a zero sum game if you could play for free. Obviously you can not because every trade will cost you something. With this notable exception to the zero sum equation of trading stocks, someone still has to lose a dollar for you to make one. For most individuals that makes the game of trading stock into a war or the analogy is not far off.

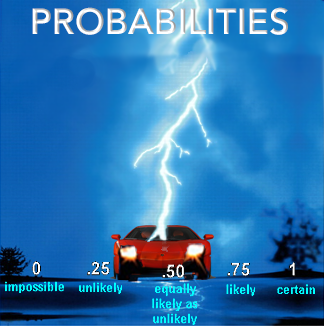

No one can know what tomorrow will bring and thus no system can predict with 100% certainly what direction any stock will move in the future. What technical analysis excels at is identifying trends and patterns and the likelihood that those trends will continue or the pattern repeated. Because all TA indicators are utilizing historical data, many of these indicators contain a delay or lag in their signal.

Armed with this knowledge a trader can dramatically improve their chances of being and staying on the winning side, i.e., profitable. World events, economic news, weather, commodity prices, Internet based technical glitches are just a few of the monkey wrenches that can interfere with the outcome your indicators my be displaying. So be cautious when you are trading based on any technical analysis indicator. Remember that the best they can do is provide you with a higher probability that your stock will react in the manor the indicator is indicating. Use the information to prepare yourself and your trade so that you will be able to quickly respond to what the price actually does, not what your indicator is indicating it may do. The requirement to be on “High-Alert” is critical when stocks are nearing an area of likely change in direction. Technically this will occur primarily at support and resistance levels, but it can happen at anytime and for seemingly no reason at all. Analyst can issue a new analysis of your companies stock at anytime, fundamentally changing how the market views your stock. A commentator on a financial television show could praise or trash your stock at anytime without your knowledge, again affecting the stock. Fundamentally pivots can occur every three months when Quarterly earnings are reported and the associated conference calls are announced. This also creates the same type of risk/opportunity that can cause your stock to suddenly change it's rate of change or it's direction.

Technical analysis is all about spotting a stock's trend and making sure that you are on the correct side of that trend. As a swing trader, I try to identify and ride a given trend for a period of several days to several weeks. Just as important, I also attempt to identify changes in trend as soon as they begin to take shape.

The perfect market premise, states that the current price of any equity reflects the sum of all available information and the sum of the combined sentiment of all of the traders in this stock. This also assumes that everyone who knows anything is acting in the market out of his or her own profit motive, based on his or her view of where a stock will go in the future. If you think it’s going higher, using whatever information or analysis one has on hand, you are a buyer. If you believe that it will go down, you can sell or short the stock. Given this premise, everyone is voting with their dollars and the collective “wisdom” of the market is all reflected in the current price.

Supply and Demand fluctuates in direct response to these changing situations, but the result is the same as any other market. If demand is greater than supply the price will go up. If supply is greater than demand the price will go down. Volume is the ultimate determining factor to make this determination, but must be combined with price to make the final determination.

StockDotGenie (SDG) excels at identifying areas of volatility where turning points are likely and then provides you with definitive trading indications by analyzing recent price and volume. By applying all of your global, information analysis, combined with the signals provided by SDG, you can make time critical, successful trading decisions.

SDG relives traders of the necessity of initially learning or understanding multiple Technical Analysis Indicators. Every additional TA indicator that you add to your analysis increases the likelihood of more successful and profitable trades.

An Excellent Traders Financial Dictionary is linked here.

FinViz's screener also provides a quick way to refresh your memory on financial terms. In the screener under the "Fundamental" tab, a concise definition is provided of each financial term when you mouse over them.

Definitions of Technical Analysis Terms can be found here.

The Market Technicians Association (MTA) maintains an excellent Technical Analysis resource here:

Good Luck!