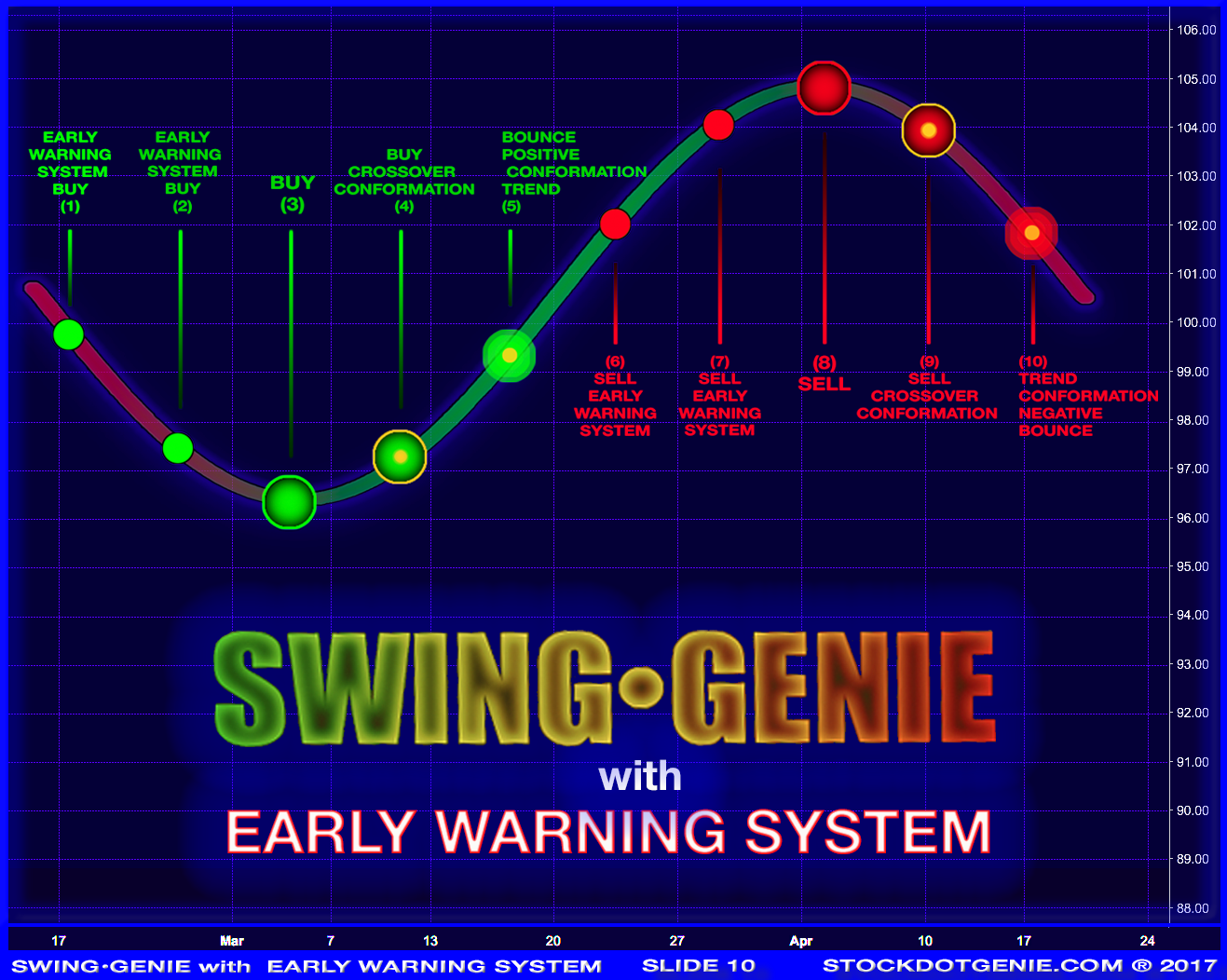

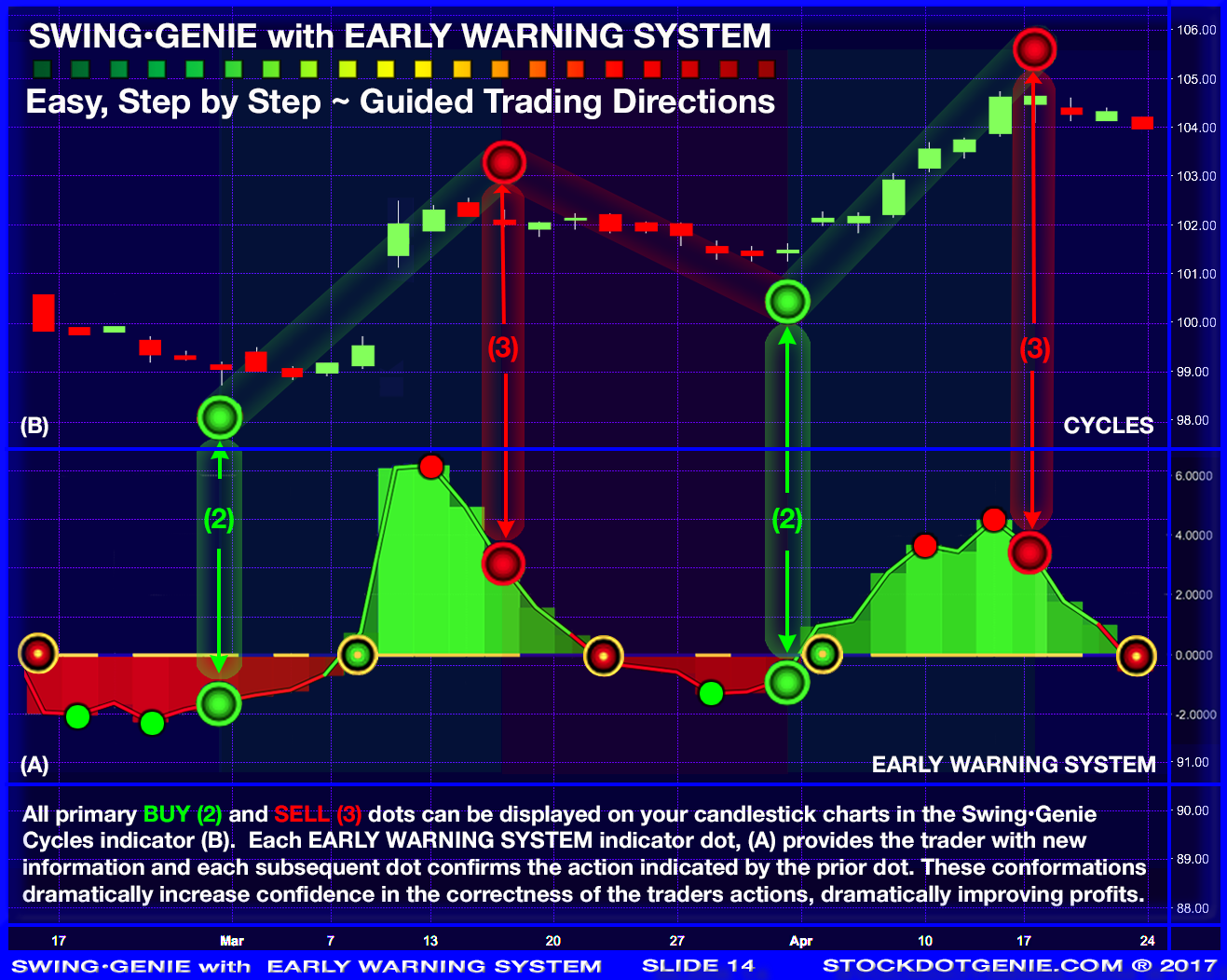

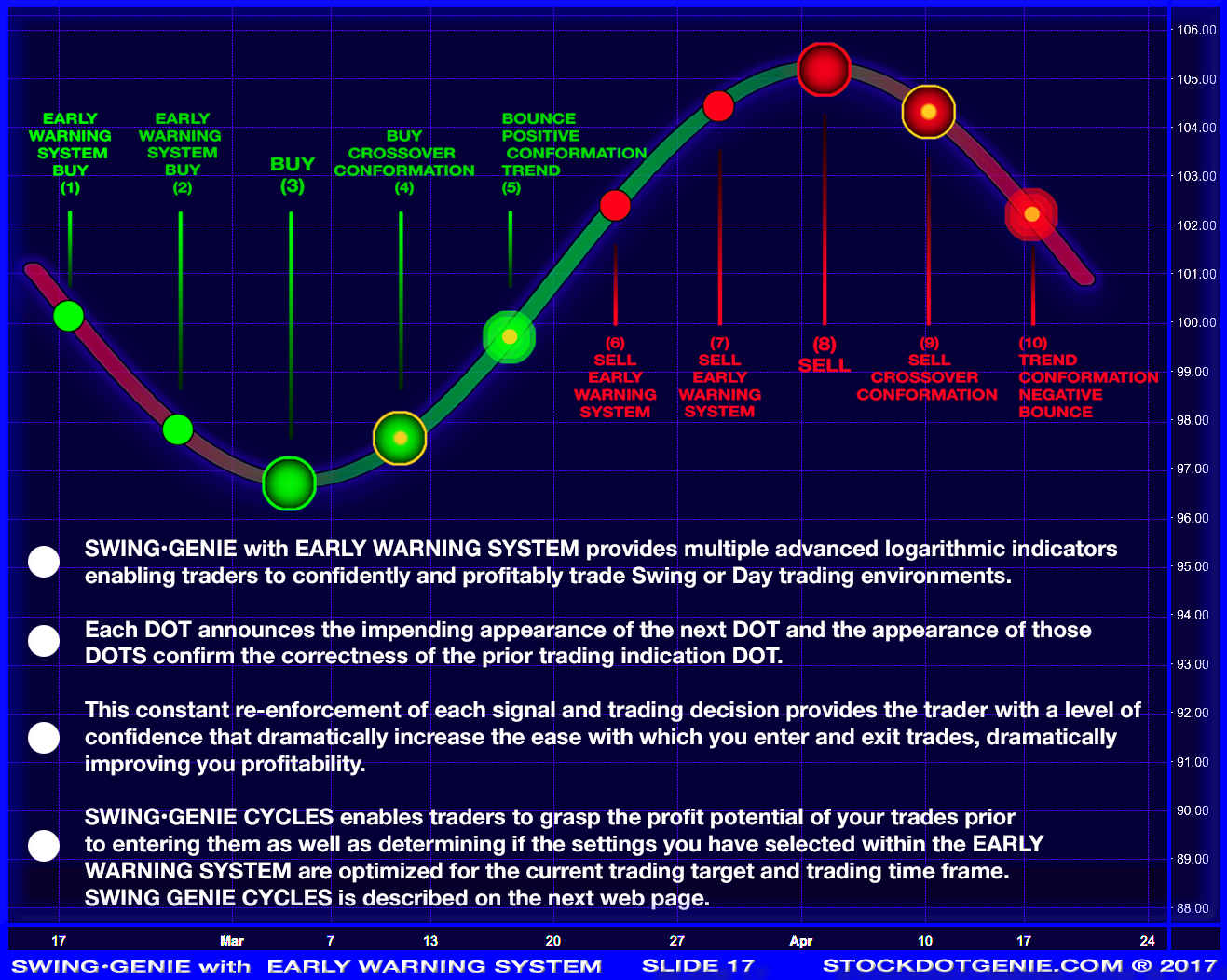

The EARLY WARNING SYSTEM signals traders of impending turning points in a stock’s trading trajectory. Red Dots (•) and Green Dots (•) indicate a high probability of a trend direction change occurring in a relative short period of time. The EWS Indicator generates signals by passing the current price through the result of a Laguerre filter. A Laguerre filter is an advanced calculation of a moving average. This calculation is then outputted as a static i.e., normalized horizontal line plotted at zero on the EWS chart. The closing price is then passed through the output of this filter, resulting in positive bars drawn above and / negative bars below the normalized filter or zero line. The resulting bars are then analyzed, determining there relative sizes and the shape of the array or pattern recognition, to determine if EWS signals have been generated.

• The Early Warning System (EWS) deconstructs your stock chart and then reconstructs it, (see captioned animation above) allowing traders of any technical skill level to completely, instantly and intuitively understand the forces driving your stock's price and future trajectory.

• It often takes years for traders to develop the skills required to quickly and instinctively analyze a stock chart and then be able to determine where that stock will go next with a very high level of confidence. Swing•Genies Early Warning System (EWS) provides to the novice, experienced and professional traders this ability the first time they use it

• EWS exposes parabolic swings that can be all but invisible to any other trading indicator.

• Each parabolic swing is broken down and the resulting histogram is analyzed by pattern recognition to provide the trader with signals that; 1) alerts the trader of approaching opportunities; 2) signal optimal entry and exit flags and finally; 3) provides a confirmation signal that the stock is continuing on the path projected by the indicator.

• Each signal in the series is confirmed by the appearance of the next signal in the series.

• SWING•GENIE works for any equity, market or financial instrument in any time frame, at any level of volatility.

• The guided feedback provided by Early Warning System dramatically increase the trader’s confidence to enter and exit trades immediately as the most profitable opportunities present themselves.

• Advance the instructional slides below using the arrows (<>) on the right of the left of the slides.

Slides can be advanced by clicking on the large slide, using thumbnails above or the "<" ">" controls provided at the left and right edge of each slide.

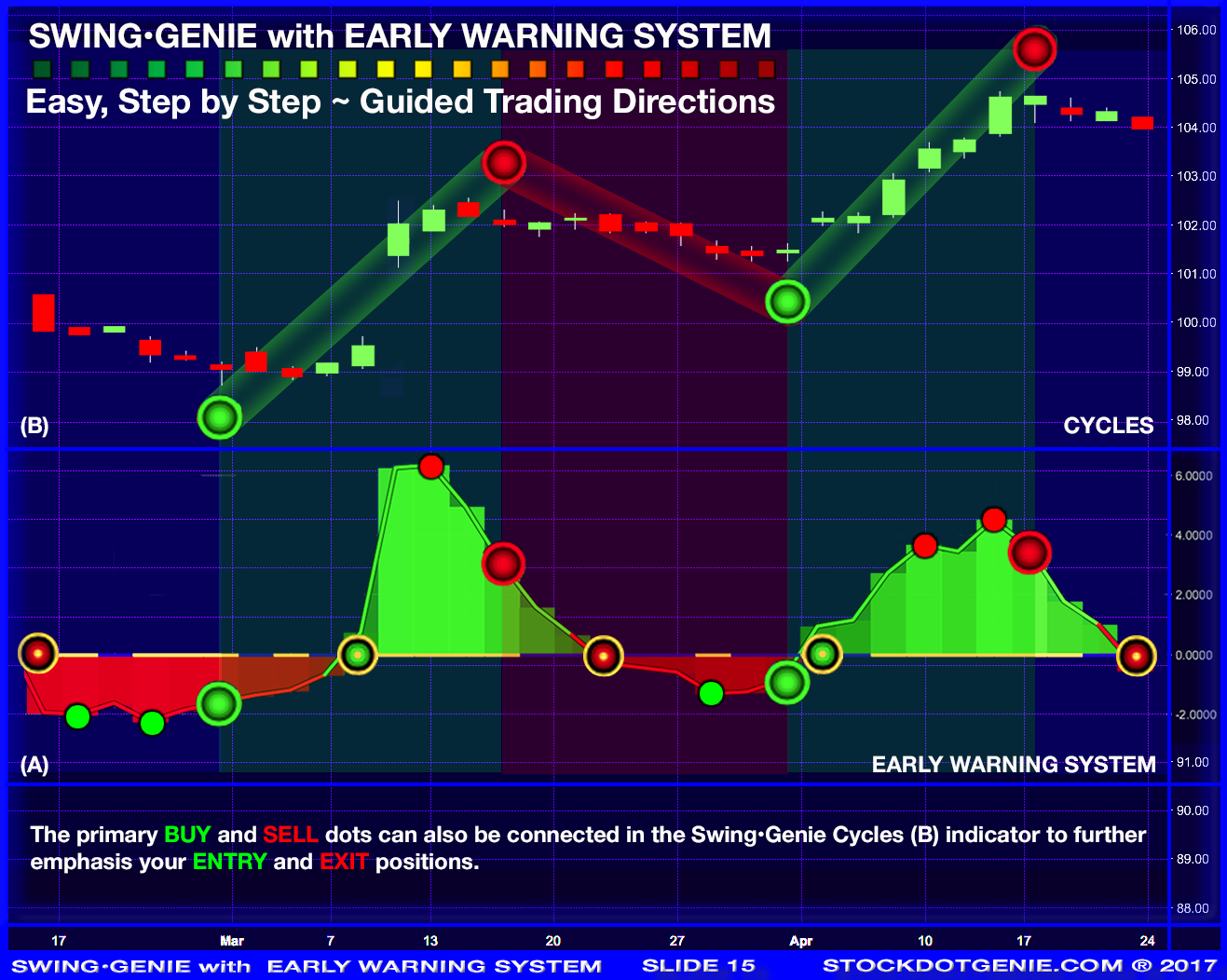

Swing•Genie and the Early Warning System are actually two different indicators. They are displayed on the same indicator chart with each providing separate and distinct pieces of the Swing•Genie swing/day trading signals.

Swing•Genie produces the primary Buy and Sell signals and utilizes a hybrid moving filter comprised of multiple algorithms, each utilized to provide a specific attribute that dramatically improves your timing success in swing or day trading situations.

Two centers of gravity (COG) filters are first utilized because of its unique ability to accurately identify turning points. The first COG indicator is looking back 10 bars and utilizes the center point of each's barred range as the input. The second COG is a shorter period of 6 bars and it is utilizing the close of the day as its input. These two COG filters are then converted into a Pass Band Filter (PBF) by subtracting the shorter length filter from the longer length filter. Finally, the output from the PBF is utilized as the input for an ALMA filter.

ALMA is a Gaussian distribution shifted filter with an offset that is not centered on the data’s window but slightly shifted to the left of the most current data. This offset is adjustable so the trader can balance between smoothness and responsiveness. The data window size is also adjustable allowing the amount of data included within the filter to be dialed in. The third parameter is Sigma, which determines the filter’s shape and is also adjustable enabling the trader to widen or shorten the filters focus. Another unique attribute of the ALMA filters is the removal of small price fluctuations, enhancing the trend by applying a moving average twice, once from left to right and once from right to left. This process (Zero-phase digital filtering) reduces noise in the signal, further reducing phase shift (price lag) commonly associated with moving averages. ALMA invented by Arnaud Legoux and Dimitrios Kouzis Loukas.

The default inputs utilized in the ALMA settings are:

Window size (3), Offset float (0.67) and Sigma Float (1.1).

It should be noted that every component of the Swing•Genie hybrid moving filter has been optimized to produce accurate trading signals within the short time frames encountered in Swing/Day trading environments.

The output from this algorithm is simply two dots, a green Entry/Buy dot and a red Exit/Sell dot. The dots have the ability to be connected producing a visual zigzag effect that highlights the parabolic swings captured by this hybrid moving filter.

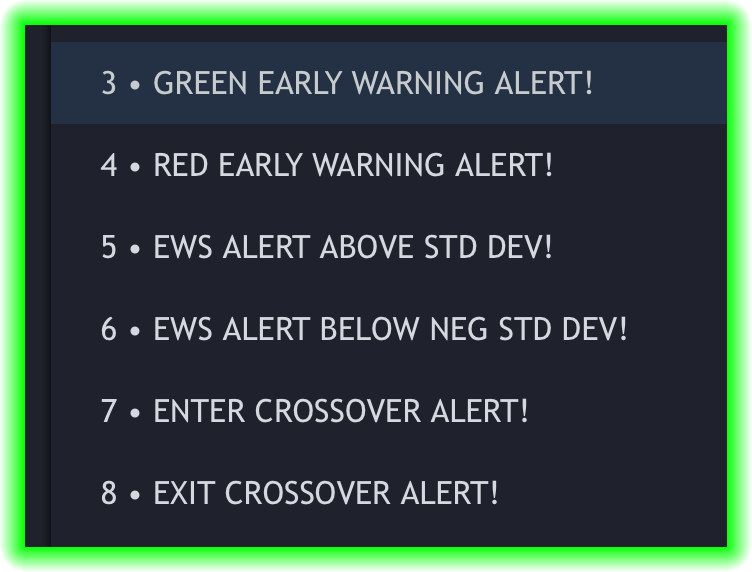

EARLY WARNING SYSTEM ALERTS:

Green Warning Dot Generation

Red Warning Dot Generation

Green Dot above STD Dev

Red Dot Below STD Dev

Green Crossover Enter Dot

Red Crossover Exit Dot

Right click on any clear space within the panel displaying the indicator you want to set an alert for. Click on “Add Alert” and use the resulting drop down menu to chose the alert you want to utilize. All Genie alerts will be in all caps.